Market Review – March 2022

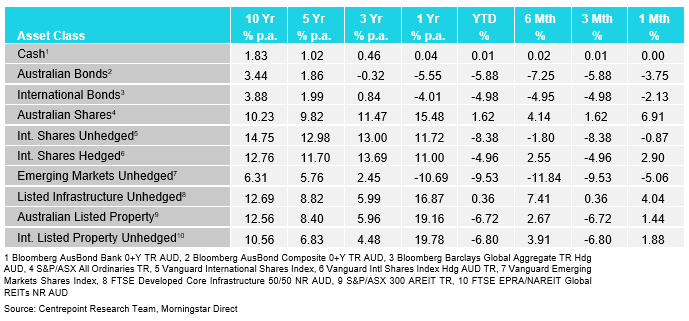

How the different asset classes have fared:

(As at 31 March 2022)

International Equities

Unhedged and hedged international equities steadied in the month of March. Unhedged fell 0.87% whilst hedged gained 2.90%. Volatility to the downside has subsided for the time being as markets try to price in the full affects of inflation and the central banks responses to this issue. Strength in the Australian Dollar has supported hedged international exposures in 2022 with the quarterly return for unhedged exposures (-8.38%) underperforming hedged exposures (-4.96%) significantly. Markets remain vigilant of the developments in Ukraine and the ripple affects to the global economy.

Australian Equities

The S&P/ASX All Ordinaries Index rose strongly by 6.91% on the month. Australia remains one of the best developed nation exposures YTD as equities continue to be supported by strong commodity prices as energy, resources and materials had a strong month. The surprising increase was in information technology however, which has struggled so far this year as they face rising interest rates. The Australian market continues to be viewed as somewhat of a defensive allocation to the economic issues persisting around the world. Commodities continue to move higher given the backdrop of inflation and supply issues that have become more persistent than expected, possibly causing inflation to remain somewhat elevated over the medium-term.

Domestic and International Fixed Income

Australian and International Fixed Income fell 3.75 and 2.13% respectively on the month. Bonds loss value globally due to an increase in rate expectations on the back of Central Banks expressing their willingness to bring inflation back down from elevated levels. The Australian 10-year bond yield rose a significant 70 basis points across the month as traders look to pre-empt a potentially earlier than expected rate hike in May rather than the expected June. This increase in rate expectations has caused Australian Bonds to sell off more than International Bonds. US 10-year bond yields rose about 45 basis points on the month.

Australian Dollar

The Australian Dollar (AUD) rose over 3% in March as money continued to rotate into equities that provide protection from the current economic environment. Since the volatility at the end of January, the AUD has moved up ~8%, coinciding with the relatively strong equity returns compared to the global market.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.