Market Review – April 2022

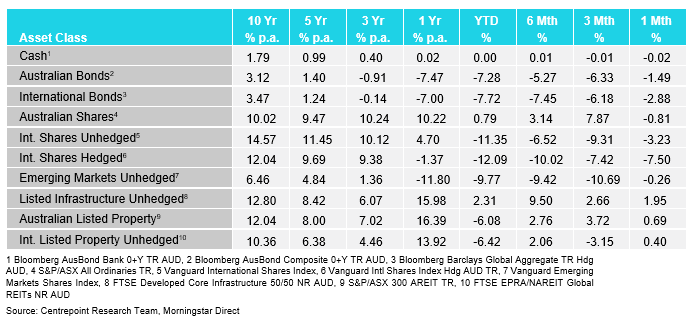

How the different asset classes have fared:

(As at 30 April 2022)

International Equities

Volatility re-entered international equities over the month of April. This resulted in a 7.5% drop in the hedged index and a 3.23% fall in the unhedged index. A sharp US dollar rally caused divergence in these two indexes as the Dollar was once again seen as the safe haven currency. US based stocks remain the most impacted globally as the NASDAQ fell a whopping 13% with the S&P 500 following closely behind with a 9.6% fall. Consumer discretionary fell the most, followed by communication services and technology. Consumer discretionary has been severely impacted by inflation and the reshuffling of budget priorities by consumers as ‘needs’ are prioritised over ‘wants’. This is combined with the impacts of rising interest rates, especially on the technology sector. At the end of the month, GDP data came out of the US at a negative 1.4% QoQ (quarter on quarter) number, suggesting a significant slowing in the US economy may already be here.

Australian Equities

Australian shares took back some gains in the month of April as the index declined 0.81%. The Australian stock market remains resilient thus far in the face of steepening yield curves and inflation heating up. Australia finally got the CPI number that was expected to arrive sooner or later. Australian inflation hit a 21-year high of 5.1% in the first quarter of 2022 as Australia joined the globally synchronised rise in inflation. Australia remains well-positioned to deal with a rise in inflation from an equity market perspective relative to other countries due to the index comprising of high weightings to materials, energy and financials.

Domestic and International Fixed Income

Domestic and international bond indexes continued their decline, falling 1.49% and 2.88% respectively. This continues an already historic decline in the bond indexes. These indexes are down 5.27% and 7.45% calendar YTD (year to date) currently. This scenario is something that bond holders are not accustomed to as capital preservation and significant gains has been achieved for decades via holding bonds. Significant inflation has caused interest rates to adjust upwards quickly. The question is how high can these rates really go without causing too much pain in the economy and markets?

Australian Dollar

The Australian Dollar (AUD) fell 5.7% in April on the back of a strong United States Dollar (USD). Significant volatility in international foreign exchange markets resulted in a move into the safe-haven USD and caused devaluations in nearly all currencies priced in USD, suggesting the strength in the currency is the cause for the move as opposed to the weakness in the other currencies priced in USD.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.