Market Review – December 2022

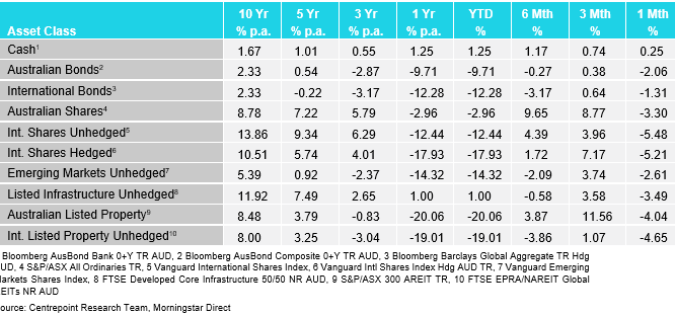

How the different asset classes have fared:

(As at 31 December 2022)

International Equities

After a couple months of positive gains, markets retraced by -5.48% and -5.21% in unhedged and hedged international equities to end the year 2022. All three major US markets (Dow Jones, S&P 500 and NASDAQ) had their worst years since 2008. During December, markets started to price in a recessionary environment with elevated interest rates. This combination is rare as a recessionary period generally comes with a lowering of interest rates. Members of the United States Federal Reserve Bank have continued to keep expectations focused on higher interest rates throughout 2023. Indications of a slowing economy are forcing the markets to second-guess just how sustainable this is, however. Materials, information technology and consumer discretionary were the hardest hit sectors on the month and are indicative of recessionary (materials and consumer discretionary) and interest rate (technology) factors negatively impacting the market.

Australian Equities

Australian shares were not sheltered from this general market sell-off. The Australian market was down 3.3% in December with Technology, Real Estate and Industrials leading the way down. Whilst the Australian market was down overall on the market weakness, the materials sector was buoyed by the reopening of China from their Covid-Zero policy. Energy and utilities also outperformed the ASX 200. Australia ended the year being the best performing index compared to the US, Europe, and Emerging Markets, only falling 5.5% on the year.

Domestic and International Fixed Income

International and domestic bonds had a negative month to end the year. International bonds fell 1.31% and domestic bonds fell 2.06%. The US raised rates another 50 bps (0.5%) in December and reaffirmed their commitment to stamping out inflation. This was perceived as negative for bonds as higher interest rates for longer amounts of time put downward pressure on bonds. Bond values will increase when interest rates fall. A battle between bond traders and central banks is currently occurring. Bond markets are trying to suggest that interest rates should be lower by the end of 2023 due to a weakening global growth picture, however central banks thus far have remained adamant that interest rates will remain elevated. Throughout 2023, we will see who is correct.

Australian Dollar

The Australian Dollar (AUD) rallied 1.2% during December. This was aided by the US Dollar (USD) continuing its drop from the extremely elevated levels seen during its historic rise in 2022. This has allowed the Australian Dollar to continue to move higher from the lows of 0.63 AUD/USD in October this year. If economic growth expectations continue to deteriorate and inflation moderates in the United States, the Australian Dollar will benefit. If either of these trends reverse, the AUD could still move lower.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.