Market Review – March 2024

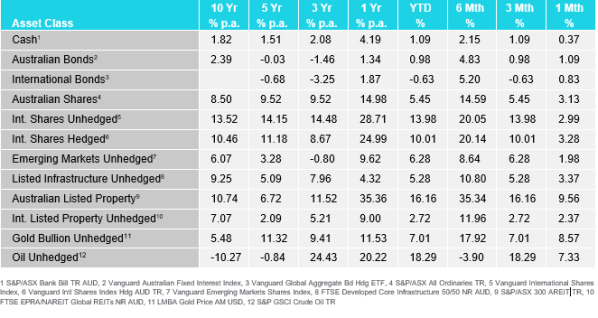

How the different asset classes have fared:

(As at 31 March 2024)

Key Themes:

- Equity Markets continue to make gains: US and Australian stock markets continue to hit record levels, driven by a resilient economy and expectations of nearing rate cuts.

- Fixed Income had a quiet month but continues an upward trajectory: Both international and Australian bond prices rise marginally as investors await further hints from Central Banks.

- Australian Dollar mostly flat: The Australian Dollar ended the month slightly up by 0.7%.

- Commodity Prices outperform: Oil prices rose due to geopolitical unrest and supply cuts, whilst gold rallies on hopes of imminent rate cuts.

International Equities:

Led by the US, international markets experienced their fifth-consecutive month of gains, rising by 2.99%. This closed off the first quarter of 2024 with a return of 13.98% making it the best quarterly start to the year since 2019. All three major US equity indices (S&P 500, Dow Jones and Nasdaq) all reached new highs in March off the back of growing investor optimism that the US Federal Reserve will cut rates three times over the course of the year, delivering a soft landing which will support corporate performance and earnings. The recent rally was once again led by technology stocks, with the star performer NVIDIA now accounting for over 24% of the S&P500’s quarterly return. Notably in March, small caps managed to keep up with the larger names, highlighting a broader rally from an increasingly positive macroeconomic outlook.

Elsewhere, Europe performed well in March with countries such as the United Kingdom posting positive performance for the month as investors appear to be on the hunt for discounted markets in the hope that we have turned a corner on a global scale. There were also notable movements in Japan where the BOJ (Bank of Japan) increased interest rates for the first time in 17 years. This led to the Japanese Yen falling to all time lows providing a boost to equities. Value stocks were also favoured in March across every region.

Australian Equities

Closely following global equities, the Australian stock market returned a healthy 3.13% in March which closed off a strong first quarter of 2024. Despite overall gains the Australian market experienced volatility, peaking in the start of the month and then slumping before rebounding in the final stages. Like global markets, much of the monthly return was driven by improving sentiment surrounding central bank rate cuts and the likelihood of avoiding a severe economic downturn.

Real estate was the greatest contributor to performance in March with the S&P/ASX 200 A-REIT returning an impressive 9.56%. Further signs of cooling inflation and hints of central bank rate cuts in the near future provided a boost to the real estate market as median prices rose by 1.6% over Q1 2024, up from 1.4% in Q4 2024. Energy also performed well for the month off the back of rising oil prices caused by the prospect of continued OPEC+ supply cuts and ongoing attacks on Russia’s energy infrastructure. Aside from Real Estate, performance over the month was broad with all but one sector finishing in the green. Communication services was the outlier and was the only sector to see a negative return over the month, likely due to idiosyncratic issues rather than any broader theme.

Domestic and International Fixed Income

Throughout March international bond prices grew by 0.83%. Persistent inflation figures meant that there were no new surprises in March and ultimately it was a less volatile period, lending itself for a buy and hold strategy for fixed income investors. It is still important to note that the US yield curve remains inverted (a key recession indicator). Over the last two years we have experienced central banks act in unison to combat rising inflation, however for the first time we are starting to see divergence in the market. This was highlighted in March where the Swiss central bank cut rates, whilst Japan hiked rates. Corporate credit performed well over the month, spurred on by a positive outlook for company earnings and supported by a surge of new credit issuance into the market.

Australian fixed income outperformed international fixed income in March returning 1.09%. This was caused by the RBA switching to a more neutral stance in terms of interest rates, although the RBA is not yet hinting at rate cuts, the removal of their hawkish stance was enough to improve investor sentiment. Similar to the global theme, credit also performed well over the month supported by a high level of credit issuance.

Australian Dollar

The Australian Dollar gained almost 2.5% against the US Dollar in the early stages of the month before reversing and ultimately settling at 0.652 just slightly above the levels we saw at the start of the month. The reversal we saw came after hotter than expected data in the US suggesting to investors that the Federal Reserve could delay or reduce the number of rate cuts over the year.

With the Japanese Yen (JPY) reaching all-time lows following the recent rate hike it is no surprise that the Australian Dollar strengthened against JPY. Overall, the Australian Dollar did not make any drastic movements, despite some volatility over the course of the month, AUD ended the month at levels not far from the start across most currency pairs.

Commodities – Gold and Oil

Commodities were amongst the best performing assets in March, with both energy and metals outperforming the broader market. Oil returned 7.33% over the month caused by tighter supply (OPEC+ pledging to further cut output), a resilient global economy and geopolitical uncertainty (particularly in Russia where Ukraine have attacked key energy infrastructure). Gold similarly had an impressive month returning 8.57% stemming from the hope of rate cuts in the near future. Gold tends to fare well in a low-rate environment and is also supported by a weakening dollar.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.