Market Review – August 2024

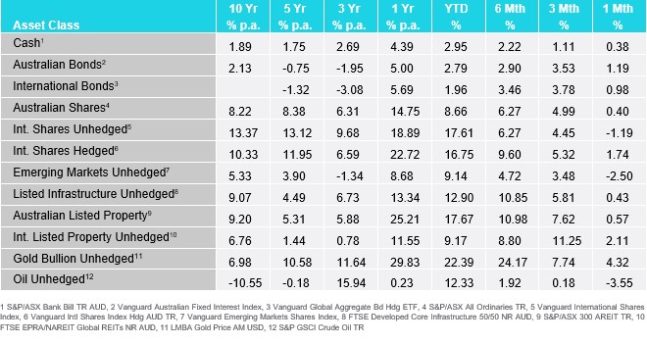

How the different asset classes have fared:

(As at 31 August 2024)

Key Themes:

- Equities made a significant recovery: Both international and Australian equity markets continued to grow despite a significant downturn at the start of the month.

- Fixed Income continues to rise: Both international and Australian bond prices continued to rise, and yields fell in the face of rate cut expectations.

- Australian Dollar appreciates: The Australian Dollar has appreciated as investors expect Australian rate cuts to come later than rate cuts in the US.

- Commodities ended mixed: Oil fell on falling demand whilst gold rose.

International Equities

In August we saw continued deviation between the hedged and unhedged share class within international equity albeit in opposite directions to what we saw in July, with unhedged equities returning -1.19% whilst hedged equities returned 1.74%. This disparity occurred as the depreciation of the Australian Dollar (AUD) against the US Dollar (USD) from July reversed and the AUD appreciated by 4.13%. This appreciation stemmed from the belief that the US Federal Reserve will be cutting interest rates much sooner than the Reserve Bank of Australia (RBA). After the brief, yet not insignificant, downturn at the start of the month global equities recovered quite well, with four sectors ending the month at similar levels of growth. Those sectors were Technology at 4.85%, Real Estate at 4.73%, Industrials at 4.60%, and Health Care at 4.56%. This growth in global equities continues to be fuelled largely by positive investor sentiment, particularly in the Technology sector where valuations are already stretched by the A.I. boom.

The two worst performing sectors still yielded positive returns despite their initial downturn, those sectors were Communication Services which grew by 1.37% and Energy which grew by just 0.73%. Returns in the Energy sector was limited due to uncertainty surrounding geopolitical tensions in the Middle East as the feud between Israel and Iran continued to pick up.

Australian Equities

The Australian equity market did not recover from the downturn at the start of August as effectively as the global market, growing by just 0.40% over the course of the month. The best performing sector was the Technology sector which returned 6.15%, followed by the Industrials sector which returned 3.76%. The Technology sector benefited from a number of companies which posted strong results such as WiseTech Global and Life360 which grew by 24.3% and 17.5% respectively. Despite strong growth in the sector this had little effect on the over S&P/ASX 200 index due to the small weighting of technology stocks in the index.

The majority of the S&P/ASX 200 sectors retracted in August, with Energy falling the most by 7.80%, followed by Materials which fell 2.82%, and Utilities close behind falling by 2.27%. Energy suffered due to the initial downturn and failed to recuperate from the low due to increasing tensions in the middle east between Israel and Iran and the expectation of growth slowing across the globe. Much of the market also faced a similar fate, falling in the first few days of the month and then failing to reach positive territory due to subdued investor enthusiasm in the Australian share market, especially in comparison to the global market.

Domestic and International Fixed Income

In August Australian bonds returned 1.19%. Australian CPI fell to 3.5% in July, down from 3.8% in June. This reduction in CPI provides evidence to investors that the effects of the interest rate hikes over the last two years are being felt in the economy, and as a result the RBA may start to consider cutting interest rates at some point in the not-too-distant future. The hope of future rate cuts contributed to a reduction in yields in the Australian 10- and two-year bonds, with the 10-year bond yield falling by 2.70% and two-year bond yields falling by 6.07%. This reduction in yields led to a corresponding increase in the price of bonds.

International bonds grew by slightly less than Australian bonds, growing by 0.98% in August. US bond yields fell in August as signs of economic weakness in the United States continue to grow, such as the notable release of the July unemployment data in the US which triggered the Sahm Rule. The Sahm Rule is a recession indicator which states that when the three-month average US unemployment rate increases by 0.5 percentage points or more from the 12-month low, the US has already entered a recession. The Sahm Rule was recently triggered when unemployment increased to 4.3% in July. This provided further fuel to the belief that the Federal Reserve would begin to cut interest rates at their September meeting. This resulted in two-year bond yields falling by 5.72% and 10-year bond yields falling by 1.77%. Two-year yields fell comparatively more as investors expect interest rates to fall more in the short term than in the long term.

Australian Dollar

In August the Australian Dollar appreciated against the US Dollar by 3.94% from 0.65 to 0.68. This was essentially a reverse of the depreciation that occurred over the course of July. As rate cut expectations continue to grow in the US and expectations in Australia continue to lag investors see greater opportunity for returns by holding higher yielding bonds in Australia, this generates demand for the AUD over USD.

Commodities – Gold and Oil

The price of oil fell by 3.55% in August despite continuing conflict in the Middle East and OPEC supply cuts. The conflict between Israel and Iran has reportedly had no material impact on oil in the region currently but a further escalation could worsen this impact. The effect of these supply shocks has been undone by lowering demand for oil in the United States and China, due to slow or slowing economic activity in both countries.

The unhedged gold price rose by 4.32% in August for much the same reason as last month. With a US rate cut expected in September and bond yields falling, gold becomes more attractive against its lower yielding counterpart.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.