Market Review – September 2024

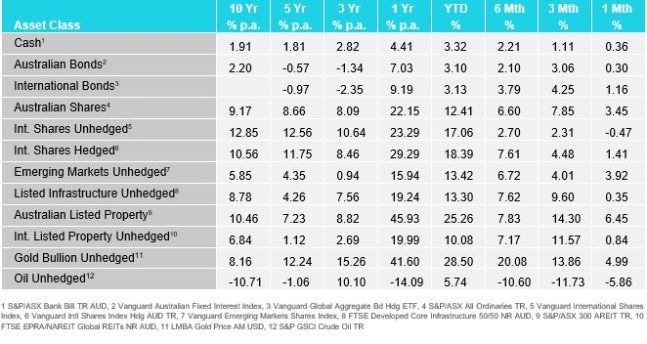

How the different asset classes have fared:

(As at 30 September 2024)

Key Themes

- Equities continued to grow: International equities rose due to excitement from investors surrounding the first interest rate cut of this cycle by the Federal Reserve. Australian equities also rose off the back of some of this excitement, but the strongest performing sector was Materials which grew by 11.01% as investors expect stronger future demand after China’s announced economic stimulus efforts.

- Fixed Income rose: Both international and Australian bond prices continued to rise but at different rates. U.S. two-year bonds yields fell considerably on the hopes and reality of the Federal Reserve’s rate cut while Australian bond yields only fell slightly as there were no major domestic economic data surprises to shake up investor expectations for interest rate cuts.

- Australian Dollar appreciates: The AUD continued to appreciate against the USD due to the difference in interest rates and yields between the two countries, as well as expected increased demand for Australian trade if China’s economic stimulus reinvigorates their economy.

- Commodities ended mixed: Oil continued to fall due to announced production increases from OPEC+ and general economic uncertainty in major oil importer China. Gold continues to grow as the Federal Reserve makes its first rate cut of the cycle and expectations for lower interest rates continue in many major markets.

International Equities

In September hedged international shares continued to outperform unhedged international shares, hedged returned 1.41% while unhedged returned -0.47%. Hedged continued to outperform unhedged due to the appreciation of the Australian Dollar (AUD) against the U.S. Dollar (USD). This appreciation occurred due to the market expecting a 50 basis point interest rate cut from the U.S. Federal Reserve which became reality on the 18th of September. With lower interest rates relative to Australia there is greater demand generated for the AUD over the USD so that investors can gain access to the currently higher interest rates in Australia.

Eight out of ten global market sectors had positive returns in September, with Utilities, Consumer Discretionary, and Materials leading the charge returning 5.26%, 5.09%, and 4.43% respectively. Investors were drawn to the Utilities sector due to the sector’s sensitivity to interest rates following the September rate cut in the U.S. and its defensive nature following general volatility in the global market. Consumer Discretionary was also helped by the rate cut in the U.S. as consumers gained greater confidence and optimism in the overall economy and expected less financial burden from interest rates in the future.

The two sectors that fell in September were Health Care which fell by 3.08% and Energy which fell by 3.53%. Energy had a considerable reduction of 7.34% at the start of the month following a steep decline in the price of oil but the sector slowly recovered over the month.

Australian Equities

Australian equities grew by more than international equities in September, rising by 3.45%. The three sectors that performed the best were Materials, Technology, and Real Estate, each growing by 11.01%, 7.36%, and 6.49% respectively. Materials was negative for most of the month until the Peoples Bank of China announced a slew of stimulus designed to reignite their economy and fix their issue with deflation. As China is a major trading partner with Australia, a stronger Chinese economy means more demand for Australian materials. The Technology sector grew after spirits where heightened by the first U.S. rate cut of the cycle, WiseTech Global was a major winner, growing by 12.96%. Real Estate also grew due to the U.S. rate cut and investor expectations for the first rate cut in Australia.

On the downside the three biggest losers were Health Care which fell by 3.82%, Consumer Staples which fell by 2.98%, and Energy which fell by 2.08%. Health Care continues to underperform the rest of the market as the sector is beset by high costs from recent inflation. Consumer Staples retracted as the two largest stocks of the index, Woolworths and Coles, were sold off after the Australian Competition and Consumer Commission (ACCC) alleged that they had breached Australian Consumer Law by briefly increasing prices for products before they were discounted. Similarly to international markets the Energy sector fell as it followed the falling price of oil in September.

Domestic and International Fixed Income

Australian bonds returned 0.30% in September as bond yields fell slightly. There wasn’t much change in bonds during September as the Reserve Bank of Australia (RBA) kept the cash rate target at 4.35% and the lack of any major Australian economic data surprises meant that market expectations for future interest rate cuts were largely unchanged. One factor would have been investors being swept up in the expectations for a 50 basis point rate cut in the U.S. which lowered yields.

International bonds grew by quite a bit more, growing by 1.16% over September. A major factor in this was the Federal Reserve cutting their target interest rate by 50 basis points from 525-550 to 475-500. During the start of the month yields on U.S. bonds fell considerably. Following the Federal Reserve meeting and announcement on the 18th of September the two-year yield remained mostly stable at around -7.00% for the month while the 10-year yield rose from that level to just -3.27%. This discrepancy shows investors are expecting interest rates to fall more in the short term than in the long term and that we are in the part of the interest rate cycle where interest rates fall before a period of lower interest rates.

Australian Dollar

In September the Australian Dollar appreciated against the U.S. Dollar by 2.52%. This appreciation can be attributed to two factors, one is the 50 basis point rate cut from the Federal Reserve and lower expected yields in the U.S. than Australia, and the other is the recent announcement of China’s economic stimulus effort to reignite their economy and stop deflation. The rate cut and expected yield differences attract investors to the Australian Dollar in order to access better risk-free returns than in the U.S. and if China’s stimulus does help their economy it will increase their need for Australian trade and in turn increase the demand for the Australian Dollar to fund that trade.

Commodities – Gold and Oil

The price of oil continued to fall in September, falling by -5.86%. Prices have been pushed lower recently due to OPEC’s announced plan to increase production following supply cuts during the first half of the year as well as general economic weakness in China, a top importer of oil. There was some slight recovering near the end of the month following the announcement of China’s economic stimulus, but we are yet to see if it will have a lasting impact.

The unhedged gold price rose by 4.99% in September, continuing its general trend with falling interest rates. This trend was momentarily quickened by the U.S. Federal Reserve rate cut and the corresponding lower yields on bonds.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.