Market Review – May 2021

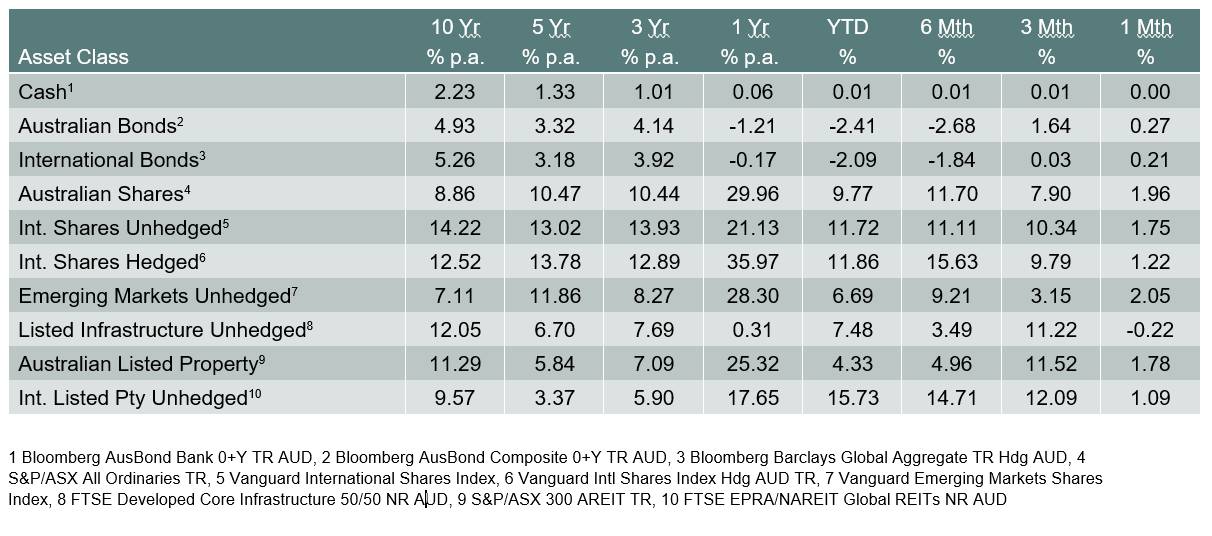

How the different asset classes have fared:

(As at 31 May 2021)

Australian and International Equities

May was a volatile month for equity markets. Inflation worries caused a drop in the first half of the month with the ASX All Ords down -1.83% at one point. It then rebounded strongly in the second half of the month, posting a 1.96% gain at the close of May, an impressive 3.75% rebound from the lows of the month. International equities in both developed and emerging markets also had a strong end to the month as inflation worries eased.

In the first half of the month, inflation worries were at the forefront of investors’ minds due to strong commodity prices and supply chain constraints. The sharp increases in commodity prices were widespread across several areas such as steel, lumber, oil and corn. Iron ore and copper prices rallied to all-time highs in mid-May. Commodity prices generally surge following a recession. This is because firms cut back during a recession and cannot ramp up production as quickly once demand comes back. Supply chain constraints also saw shortages of certain goods leading to an increase in prices. Most notably, the shortage in new cars and the price rises the second-hand car market. These factors contributed to the initial losses in the ASX early in the month, as investors worried about the impact of higher inflation on equity markets. Historically, higher inflation was a negative for equities in the short to medium term, as companies dealt with higher input prices and the potential increase in interest / borrowing rates.

During the second half of the month, inflation worries lessened as investors questioned whether the uptick will just be transitory due to the opening of economies. Commodities also fell from their highs and cryptocurrencies saw a sharp decline as China signalled their intention to curb commodity price rises and implement greater scrutiny over cryptocurrencies. Bitcoin fell from a high of $58.9k to $34.7k within the month, a decline of over -41.0%.

Domestic and International Fixed Income

Global and domestic bond yields remained stable over May. However, there were early indications that many central banks may start tapering sooner than expected given the recent economic data.

COVID and vaccines

COVID concerns remain at the forefront. While case numbers across the world have been declining, there is no room for complacency as evidenced by the recent lockdown in Melbourne. Concerningly, other countries such as Vietnam and Taiwan, which have been successful in dealing with COVID have seen renewed increases in the number of cases. The vaccine roll-out continues across the world and it has shined a light on the discrepancies in vaccine availability between developed and emerging countries. Approximately 8.0% of the population of emerging countries have been vaccinated vs 38.0% in developed countries.

Australian Economy

Locally, aside from the recent lockdowns in Melbourne, the Australian economy has grown with employment now above pre-COVID levels. The Federal government announced its 2021-22 budget, which will be stimulatory, with an expected deficit of $161 billion. Fortunately, the higher iron ore prices and stronger economic growth will help fund part of the budget rather than the Australian government issuing a massive supply of bonds.

Going forward, key risks include inflation scares, the persistent spread of COVID, the effectiveness of vaccines against new variants and geopolitical tensions. However, with the vaccine rollout, opening of economies, fiscal stimulus, and rates still at low levels, the local and global economies look well placed to continuing growing.

Australian dollar

The Australian dollar has been steadily weakening since mid-May with the fall in commodity prices.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.