Please read Viewon Financial Advisory articles below for valuable information on various topics relating to personal financial services.

Market Review – October 2023

How the different asset classes have fared: (As at 31 October 2023) International Equities International Equities fared better in October than September but still retreated as both unhedged and hedged shares fell by 0.98% and 2.72% respectively. Hedged falling further due to the continuing strength of the United States Dollar as the Fed retains high […]

Market Review – September 2023

How the different asset classes have fared: (As at 30 September 2023) International Equities International Equities performed poorly in September as both unhedged and hedged shares fell by 4.02% and 3.75% respectively. This result is not unexpected as there was downward pressure on equities from multiple angles, including rising oil prices and bond yields. The […]

Market Review – August 2023

How the different asset classes have fared: (As at 31 August 2023) International Equities The rise in international markets slowed in August with a 1.61% gain in unhedged equities and a 1.87% loss in hedged equities. This divergence is due to a fall in the value of the Australian Dollar relative to USD. With the […]

Market Review – July 2023

How the different asset classes have fared: (As at 31 July 2023) International Equities International markets continued their tremendous 2023 with another 2.08% and 2.86% return in unhedged and hedged equities. The Nasdaq set a half-yearly record of ~39% increase to start this year, powered by an AI-mania and falling inflation. With inflation continuing to […]

Market Review – June 2023

How the different asset classes have fared: (As at 30 June2023) International Equities In the month of June, international shares gained 3.16% in unhedged and 5.56% in hedged returns. This was a continuation of an already positive year for equities generally. This is despite the constant broadcasting of probably the most anticipated recession in history, […]

Market Review – May 2023

How the different asset classes have fared: (As at 31 May 2023) International Equities In the month of May, the international stock performance demonstrated a distinct split between hedged and unhedged shares. Unhedged shares exhibited a return of 1.20%, a surprising positive outcome considering the overall sell-off of most asset classes in the same month, […]

Federal Budget Summary – May 2023

Introduction On the evening of 9 May 2023, the Government delivered its second Budget in the current parliamentary term. Inflationary pressures, interest rates and escalating costs of living have all had a significant impact on the lives of every-day Australians. The Budget needs to deliver the right balance of spending and savings. This year’s Budget […]

Market Review – April 2023

How the different asset classes have fared: (As at 30 April 2023) International Equities International shares once again had a positive month with unhedged and hedged equities returning 3.16% and 1.68%, respectively. United States equities, the largest region within the international shares index, have only 32% of stocks within the S&P 500 beating the index […]

Market Review – March 2023

How the different asset classes have fared: (As at 31 March 2023) International Equities International shares rebounded during the month of March with a gain of 3.92% and 2.51% in unhedged and hedged international markets. Significant gains in the technology space lead the markets higher as concerns in economic health, stemming from the banking sector, […]

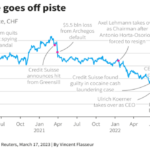

What is going on with banking? – March 2023

What is going on with banking? Prepared by: Centrepoint Alliance March 2023 1. What occurred with Silicon Valley Bank? The initial signs of weakness within the banking sector started with the amazing collapse of Silicon Valley Bank (SVB). SVB was the US’s 16th largest bank with about $209 billion USD in assets. The main depositors […]