Market Review – December 2024

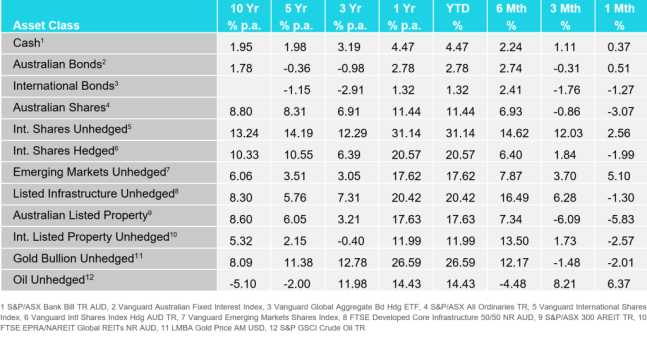

How the different asset classes have fared:

(As at 31 December 2024)

Key Themes:

- Equities fall: Both Australian equities and hedged international equities retreated in December. Australian equities fell on continuing uncertainty around China’s economic recovery and whether the RBA will cut interest rates in 2025. International equities fell following the December meeting of the US Federal Reserve, during which it was suggested that the pace of rate cuts would slow in 2025.

- Bond prices were mixed: Australian bond prices rose in anticipation of the RBA potentially cutting interest rates in 2025 while international bond prices fell in anticipation of interest rates and inflation potentially remaining high in the near future.

- Australian Dollar depreciated: The AUD continued to depreciate against the strengthening USD due to Trump’s planned tariffs and other inflationary policies. More inflation leads to higher for longer interest rates and higher demand for the USD.

- Commodities were mixed: The price of oil rose in expectation of greater demand from China and falling US oil inventories while the price of gold fell due to the strengthening of the US Dollar.

International Equities:

In December, hedged international shares fell by 1.99% while unhedged international shares rose by 2.56%. This difference between hedged and unhedged returns for international shares is due to the depreciation of the Australian Dollar (AUD) relative to the United States Dollar (USD) of around 5% that occurred in December. This depreciation saw the AUD/USD exchange rate fall from 0.65 to 0.62, increasing the relative value of unhedged investments which are held in USD.

In the US the stock market suffered following the December 18th meeting of the US Federal Reserve, at which they cut interest rates by 0.25%. At the same time, they also suggested that the pace of interest rate cuts would slow in 2025 as inflation was still not within their target range. This dampened the hopes of investors and contributed to the selloff in the market. In Asia, Chinese markets rallied following a statement that the People’s Bank of China would pursue a ‘moderately loose’ monetary policy in 2025, while in Korea markets fell due to the political instability that the country faced in December.

The only three sectors in the international stock market that posted positive returns in December were Consumer Discretionary, Communication Services, and Information Technology which returned 2.27%, 2.17%, and 0.70% respectively. All three positive sectors continued to benefit from containing members of the Magnificent Seven that have dominated the market in 2024. The rest of the market retracted with Real Estate leading the decline at -8.28%, followed closely by Materials at -7.78% and Utilities at -7.11%.

Australian Equities

Australian equities fell by 3.07% in December, starting the month at a new all-time high for the S&P/ASX 200 before retreating due to uncertainty surrounding whether there will be an economic recovery in China and the continued hawkish stance of the Reserve Bank of Australia (RBA). The two market sectors that grew in December were Consumer Staples and Energy, which grew by only 0.51% and 0.25% respectively. The Energy sector grew off the back of rising oil prices as well as rising demand for fuel and energy during the holiday season.

All other sectors retreated in December, but the biggest loser for the month was the Real Estate sector which fell by 7.01%, then followed by Materials falling 4.54% and Technology falling 4.39%. Real Estate, a highly interest rate sensitive sector, suffered due to the RBA’s continued hawkish stance on inflation and the view that monetary policy will need to continue being restrictive into 2025. Within the Materials sector mining stocks such as BHP Group and Rio Tinto fell following a fall in the price of metals globally, largely due to concerns over demand expectations from China going forward.

Domestic and International Fixed Income

Australian bond prices grew by 0.51% in December, with the two-year bond yield falling 1.46% to 392 basis points and the 10-year bond yield rising by 2.59% to 448 basis points. With the two-year bond yield falling and the 10-year rising it means that the market expects interest rates to fall in the near term and rise in the long-term, showcasing a belief in the market that inflation will come under control in the near term and the RBA will finally lower interest rates in 2025. This occurred despite the RBA continuing to state that inflation is still too high to cut interest rates.

International bond prices fell by 1.27% in December, with the two-year bond yield rising by 1.58% to 424 basis points and the 10-year bond yield rising by 9.05% to 457 basis points. This rise in yields hints towards the market’s expectation that interest rates will remain high in the near future and that inflation in the United States has yet to come under control despite the Federal Reserve cutting rates by 100 basis points in 2024. This could also be in anticipation of the incoming US president’s planned policies which could have an inflationary impact on the US economy.

Australian Dollar

In December the Australian Dollar continued to depreciate against the US Dollar, this month it depreciated by 4.99% from 0.65 to 0.62 AUD/USD. This depreciation can be attributed to the increasing strength of the US Dollar in anticipation of Trump’s tariff policies and the possibility of interest rates remaining elevated in the US. It can also be attributed to the continuing weakness of the Chinese economy and the falling prices of the materials that make up the core of the Australian economy.

Commodities – Gold and Oil

The price of oil rose by 6.37% in December, this occurred due to China’s announcement of a 3 trillion-yuan treasury bond issuance for 2025, which boosted expected demand for oil in the future. Also contributing to the price increase was several consecutive weekly declines in US oil inventories in December.

Gold fell in December by 2.01%, continuing the trend from November as the growing strength of the US Dollar reduced the demand for gold as a hedge against currency devaluation.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.