Market Review – February 2023

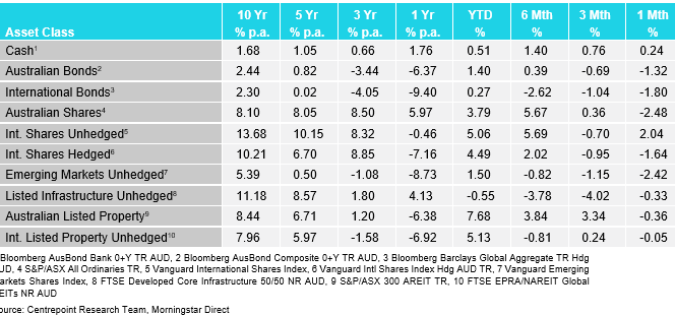

How the different asset classes have fared:

(As at 28 February 2023)

International Equities

International shares struggles in February with positive returns being eked out due to the notable drop in the Australian dollar, this is why we saw unhedged index returning 2.04% and the hedged returning a negative 1.64%. We saw weakness come from the resources sectors, real estate and utilities. The latter two we impacted by the growth concern that central banks would maintain higher interest rates for a period that is longer then what markets expected. Strength in technology stocks was somewhat surprising with investors showing a continued willingness to pay higher prices for them, even as earnings in that sector recede. Financial stocks continue to benefit from higher short-term interest rates.

Australian Equities

Australian shares fell back in February, ending down 2.48% on the month. This was led by materials and financials, resources companies also struggled as the initial enthusiasm around a China bounce back moderated. We also saw several consumer discretionary names struggle over the month with notable examples pointing to a weaker consumer outlook. The Utilities sector was the strongest performing thanks to successful, takeover confirmations.

Domestic and International Fixed Income

Fixed income had a negative month as interest rate expectations shifted upward significantly. Domestic fixed income fell 1.32% whilst international fixed income fell 1.80%. The Reserve Bank of Australia (RBA) surprised the market with the tone of its February decision. This was seen by an increase in the interest rate in February by the RBA of 0.25% coupled with the minutes of the RBA board released a few weeks later showing they are not seeing their job on lowering inflation as done yet.

In the US, we saw Federal Research Chairman Powell reinforcing recent remarks suggesting an acceleration in rate hikes will continue (i.e. hiking more than the current 0.25% pace), and may be warranted to bring inflation back to target levels, even though they see broader economic weakness in the economy continuing due to the rate hikes.

Australian Dollar

The negative economic data coupled with rising expectations in the US for additional rate rises impacted the relative attractiveness of the Australian dollar (AUD) resulting in a substantial depreciation of 4.6% for the month, paring back strong gains since late 2022.

Overall, the picture for Australia remains suggestive of a slower economy in 2023 with a tightening policy setting from the RBA reinforcing this perspective. Consensus forecasts also reflect this view seeing growth slowing to below long-term average growth of 1.8% and 1.6% for 2023 and 2024 respectively.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.