Market Review – January 2024

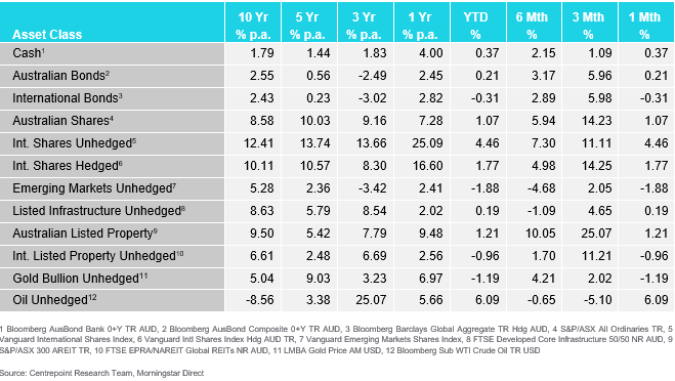

How the different asset classes have fared:

(As at 31 January 2024)

Key Themes:

- Equity Markets Reach Highs: US and Australian stock markets hit record levels, driven by economic optimism and strong sector performances, particularly in energy and finance.

- Fixed Income Fluctuates: International bonds dipped, with notable volatility in US and UK markets. Australian bonds saw slight gains amid rate cut expectations.

- Australian Dollar Weakens: The Australian dollar fell due to global tensions and domestic economic data, yet cash investments remained positive.

- Commodity Prices Vary: Oil prices rose sharply due to geopolitical unrest, while gold declined in a stronger dollar environment and risk-on market sentiment.

International Equities:

In January, the US stock market, as represented by the S&P 500, achieved a new milestone by reaching an all-time high. This remarkable performance was driven by optimism that the US Federal Reserve (Fed) is on the right path to steer the economy towards a gentle and controlled economic slowdown, known as a soft landing. The market’s enthusiasm was sparked by several encouraging signs:

- The economy’s growth rate surpassed expectations, showcasing a robust and expanding economic landscape.

- The job market delivered strong results, reflecting a resilient employment sector.

- Inflation rates showed signs of decline, easing concerns over rising costs.

However, towards the month’s end, the market gave back some of its gains. This shift occurred after the Fed hinted that interest rate cuts in March might not happen, challenging some investors’ expectations.

It’s noteworthy that growth-oriented stocks outshone value stocks, with returns of 2.1% compared to 0.4%, respectively. Small-cap stocks, which are often more sensitive to interest rate changes, faced challenges amid prospects of enduring higher rates.

On the international front, the Vanguard Unhedged International Shares Index reported a strong performance with a 4.46% return in January. Conversely, its hedged counterpart saw a modest return of 1.77%, influenced by the Australian Dollar’s weakening against the US Dollar.

In other global markets, Japan stood out (with the TOPIX index) returning an impressive 7.8%. Meanwhile, Emerging Markets faced headwinds, partly due to a stronger US dollar. China, in particular, saw subdued performance as less favourable economic data dampened investor sentiment.

Australian Equities

Echoing the success seen in the US, the ASX200 marked a significant achievement by reaching an all-time high in January. This milestone was buoyed by retail sales and inflation (CPI) figures dropping more than anticipated, sparking optimism among investors. There’s growing hope that the Reserve Bank of Australia (RBA) might lower interest rates sooner than previously thought. This sentiment fuelled a modest uptick in Australian equities, with the market seeing an overall increase of 1.07% for the month.

Leading the charge was the energy sector, which surged by 5.2%. This impressive performance was largely due to rising oil prices, spurred by geopolitical uncertainties in the Red Sea. The potential for increased revenue from higher oil prices provided a significant boost to energy stocks.

The healthcare and financial sectors also saw strong performances in January, driven by positive corporate results and an improving macroeconomic outlook. These sectors benefited from the broader market optimism and contributed to the month’s gains.

However, not all sectors experienced the same level of success. The materials sector faced challenges, with notable declines in Lithium and Iron Ore prices impacting its performance. Additionally, utilities lagged in the wake of positive inflation data from Australia. This suggests a shift in investor preference away from traditionally defensive sectors towards more risk-oriented assets.

Domestic and International Fixed Income

January was a rollercoaster month for the fixed income market, as investors navigated through a sea of economic updates and central bank announcements. The landscape for international bonds saw a slight downturn, with a decrease of 0.31% over the month. This movement was primarily influenced by the US 10-year Treasury, where we observed an increase in yields and a corresponding dip in bond prices. Despite a notable decrease in the previous month, the US 10 Year Treasury yield concluded just shy of the 4% threshold, driven upward by robust economic indicators and Federal Reserve signals suggesting that rate reductions might not commence until after March.

The UK’s fixed income market faced particular challenges, posting a -2.4% return in January. Persistent inflation concerns in the region have dampened hopes for immediate rate cuts, marking it as one of the less favourable performers in the fixed income arena. Meanwhile, Japan’s bond market continued to exhibit volatility, with investors keenly watching for the Bank of Japan’s next steps amidst uncertain economic forecasts.

On a brighter note, Australian fixed income securities offered a glimmer of stability, achieving a modest gain of 0.21%. This positive outcome stemmed from economic reports highlighting subdued retail sales and a decrease in inflation (CPI), which collectively enhanced investor optimism. The anticipation that the Reserve Bank of Australia (RBA) might advance rate cuts to stave off a severe recession led to a slight reduction in yields throughout the month.

Australian Dollar

The Australian dollar experienced its first monthly decrease against the US dollar since October. This downturn was influenced by a mix of factors that played a significant role in shaping the currency’s performance. Rising tensions in the Middle East contributed to strengthening the US dollar, while an unexpected drop in Australia’s inflation rate and softer commodity prices put pressure on the Australian dollar.

Towards the end of January, the US dollar saw another uplift. This was after Jerome Powell, the Chair of the US Federal Reserve, indicated that rate cuts were unlikely to occur in March, further boosting the US dollar’s position. Despite these challenges, it’s noteworthy that Australian dollar cash investments managed a return of 0.37%, underscoring the impact of these currency movements.

Commodities – Gold and Oil

In January, the global oil market faced a wave of uncertainty due to drone strikes on Russian energy facilities and escalating conflicts in the Middle East that extended to the Suez Canal. These events contributed to a notable increase in oil prices, with the Bloomberg Sub WTI Crude Oil index climbing by 6.09% over the month. This surge in oil prices offered a boost to energy companies, reflecting the direct impact of geopolitical tensions on market dynamics.

On the other hand, despite the heightened geopolitical unrest, gold didn’t fare as well, experiencing a decline of 1.19%. The dip in gold prices can be attributed to several factors: a strengthening US Dollar, an increase in US Treasury yields, and a prevailing ‘risk on’ market sentiment driven by a positive economic outlook. These elements combined to lessen the appeal of gold as a safe-haven asset during the month.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.