Market Review – January 2025

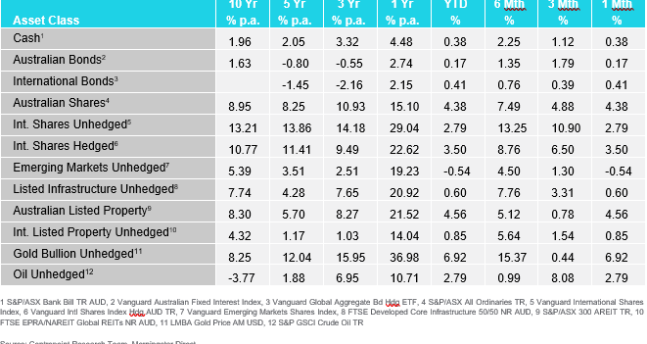

How the different asset classes have fared:

(As at 31 January 2025)

Key Themes:

- Equities rose: Both Australian and international equities rose in January. Australian equities rose as the December CPI report came in lower than expected. International equities rose despite a momentary retraction caused by the market’s reaction to China’s DeepSeek AI model.

- Bond prices increased: Both Australian and international bond prices rose, and yields fell as December CPI reports came in under expectations.

- Australian Dollar appreciated: The AUD appreciated slightly against the USD in a rebound following months of depreciation.

- Commodity prices rose: The price of oil rose in the face of greater energy demand and US sanctions on Iran oil. The price of gold also rose due to fears surrounding trade wars with the US and its potential to increase inflation pressures.

International Equities:

In January, hedged international shares rose by 3.50% while unhedged international shares rose by 2.79%. Hedged shares outperformed unhedged shares as there was a slight appreciation of the Australian Dollar (AUD) against the US Dollar (USD) of 0.74% following on from the large depreciation in December. This appreciation led to a fall in the relative value of unhedged investments which are held in USD.

The market was on track to post even stronger gains in January until concerns about the impact of the Chinese DeepSeek AI model led to Nvidia’s stock price falling by 16.97%. This wiped out almost $600 billion in market cap in just one day, the largest one-day loss for an individual company in US history. The open source and free to use DeepSeek AI model disrupted the AI market by providing capability on par with other AI models for free. Meanwhile, major technology companies such as Alphabet and Amazon have invested billions in Nvidia GPUs to build their own AI models while struggling to recoup their costs

Turning towards sector performance the three strongest sectors in international shares were Communication Services which grew by 8.70%, Health Care which grew by 6.31%, and Materials which grew by 5.11% in January. Health Care and Materials stocks saw strong growth despite being amongst the worst performers in 2024, investors may have seen a value opportunity in these sectors in the new year. Investors were attracted to the Communication Services sector as it showcased strong year on year growth during this earnings season. The biggest loser, and only sector to retract over January, was Information Technology at -1.52% as the impact of Nvidia’s losses also spread to other companies in the sector.

Australian Equities

Australian equities grew by 4.38%, outpacing international shares in January largely due to a stronger rebound following the impact of Nvidia’s sell-off on international markets near the end of the month. This stronger rebound could be attributed to the December CPI data coming in lower than expected, leading investors to believe that there is a greater chance for a rate cut by the RBA in their first meeting of the year in February. All but one sector grew in the Australian market, being led by Real Estate (4.67%), Technology (4.15%), and Industrials (3.38%). The Real Estate sector benefited from the lower CPI data as a rate cut would improve borrowing capacity and increase demand for real estate.

The worst performing sector in the Australian market was Utilities which retracted by 2.40%, falling by 4.23% on the last day of the month. The strong reaction could be attributed to the positive CPI data release. Utilities stocks, often considered defensive or value investments in an equities portfolio, tend to see lower demand when the likelihood of a rate cut increases. This is because investors shift their focus to growth-oriented sectors, which are expected to perform better in a lower interest rate environment.

Domestic and International Fixed Income

Australian bond prices grew by just 0.17% in January, with both the two-year and the 10-year bond yields ending the month slightly lower. The two-year bond yield fell by 2.52% while the 10-year bond yield fell by 0.98% to 443 basis points. Yields continued to fall as investors continued to expect a reduction in interest rates in 2025. This expectation was inflamed as the December CPI data came in under expectations.

International bond prices also grew in January, growing by 0.41%. Two-year bond yields fell by 1.00% to 420 basis points and the 10-year bond yields fell by 0.57% to 455 basis points. Investors continue to expect falling interest rates thanks to US CPI coming in slightly under expectations in December despite the increasing threat of Trump’s tariff policies, that could have an inflationary impact on the US economy.

Australian Dollar

The Australian Dollar appreciated against the US Dollar by 0.74% in January. The Australian Dollar has depreciated considerably against the US Dollar since October due to a worsening outlook for inflation in the US and continuing weakness in the Chinese economy. This slight increase can be seen as just a slight rebound following this lengthy decline.

Commodities – Gold and Oil

The price of oil rose by 2.79% in January, this can be attributed to both demand and supply side factors. On the supply side there were sanctions placed on both Iranian and Russian oil by the United States, while on the demand side there was greater demand for energy and heating due to arctic blasts causing lower than normal temperatures in the Northern Hemisphere.

The price of gold also rose 6.92% in January. This rise could stem from increasing fears of a trade war caused by Trump’s tariff policies. The uncertainty surrounding this has increased demand for gold as a “safe” asset and a hedge against a potential rebound in US inflation.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Limited ABN 72 052 507 507 and Ventura Investment Management Ltd ABN 49 092 375 258 (AFSL 253045).

The information provided is general advice only and has not taken into account your individual financial situation, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. You should consider the Product Disclosure Document for a particular product in deciding to acquire or continue to hold a product. Past performance is not necessarily indicative of future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Limited nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.