Market Review – June 2022

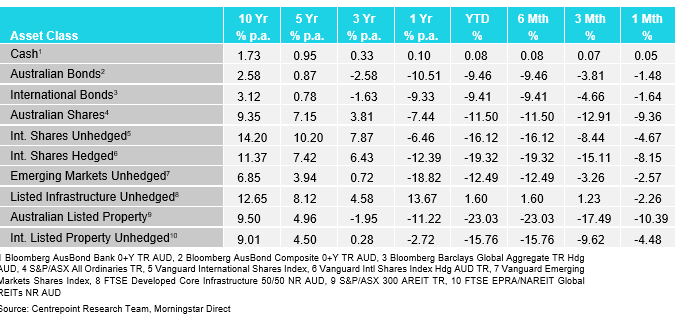

How the different asset classes have fared:

(As at 30 June 2022)

International Equities

So far in 2022, markets have been reacting negatively to both inflation and interest rates. This was occurring whilst economic growth was (and still moderately is) strong. These interest rate increases are now seeping into economic fundamentals as fears of a recession begin to surface. Hedged international shares returned -8.15% and unhedged returned -4.67%. This was the first month of a changing market narrative towards lower economic growth going forward whilst rates are being raised at this pace to impede the rise in inflation.

Australian Equities

Australian shares confirmed that the weakness in the market this month stemmed from economic weakness as the market dropped 9.36% during the month. Australia is more prone to economic slowdowns as the materials sector was the worst performer on the month. This change in underlying market dynamics is important to understand. The economic picture is weakening as Central Banks continue to raise rates to fight inflation.

Domestic and International Fixed Income

Fixed income in general fell on the month but was not the fundamental reason for equity market weakness. Australian bonds fell 1.48% whilst international bonds fell 1.64%. A reacceleration in inflation would cause further fixed income weakness. A subtle stabilisation in rates has occurred off the back of the weakening economic picture as bonds are beginning to show signs of capital protection in the event of weakening economic fundamentals.

Australian Dollar

The Australian Dollar fell a substantial 4.33% during the month of June. This further points to a general slowdown in economic activity getting priced into the currency. The Australian Dollar is viewed as a ‘risk-on’ currency, meaning it will perform well when global and domestic economic activity is strong. Strength in the United States Dollar as a safe haven from market volatility also put downward pressure on the Australian Dollar during the month.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.