Market Review – May 2024

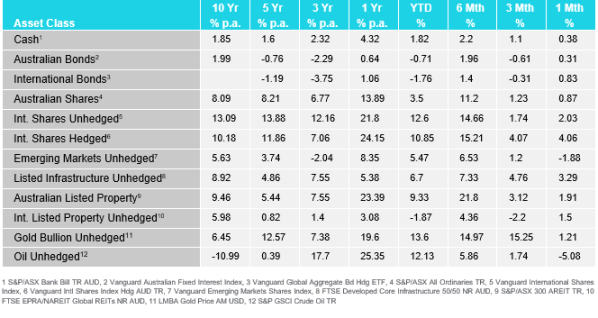

How the different asset classes have fared:

(As at 31 May 2024)

Key Themes:

- Equity markets continue upwards despite the fall in April: Both international and Australian equity markets posted positive performance over the month following promising data reports.

- Fixed Income continues to rise: Both international and Australian bond prices continued to rise, and yields fall following positive data in the US.

- Australian Dollar marginally appreciated: The Australian dollar ended the month higher following strong performance in metals and weakening US dollar.

- Commodities end mixed: Oil prices fell due to supply/demand concerns. Gold rallies, breaking the $2400 level once more.

International Equities

Following underperformance in April, equity markets rebounded in May and continued their long-term trend upwards, with many markets reaching new highs. Over the month the S&P 500 gained 4.8% whilst the tech heavy NASDAQ gained 6.88%, the Dow Jones lagged other US indices but still managed to return just over 2%. The Technology sector was the best performing sector in May, with the MSCI World IT index climbing 9.76%. Impressive performance was led by NVIDIA once again, returning over 30% for the month. However, not all US equities were able to achieve the same performance with Salesforce missing earnings and subsequently falling over 12%. Amongst the worst performing sectors were Consumer Discretionary and Healthcare however both sectors were able to finish the month in positive territory. Energy also lagged the top performers largely due to a 5.08% decrease in oil prices over the month following higher-for-longer interest rates and signs of slowing demand from China.

Elsewhere, Japan also continued its upward trend and gained over 1% following corporate government reforms which should improve transparency and subsequently encourage foreign direct investment. The UK also finished positive despite pulling back in the second half of the month given the uncertainty surrounding the upcoming election which was announced during the month.

Overall, international equities rose by 2.03% whilst the hedged version rose by 4.06%, highlighting the relative strength of the Australian Dollar against the US Dollar in May.

Australian Equities

In May, Australian Equities were once again swayed by economic data reports which offer insights to investors attempting to predict the timing of the RBA’s rate cuts. Following a turbulent month, Australian equity markets ended modestly higher, up by 0.87%.

Over the first half of May equities performed well off the back of data suggesting that the economy may be cooling. This included a higher-than-expected unemployment rate which resulted in the S&P/ASX 200 rallying over 4%. The rally was however short-lived following the CPI coming in at 3.6%, which was 0.2% higher than expected. This data flipped sentiment in a matter of days from investors questioning when the RBA is likely to cut rates, to whether the RBA will need to raise rates once again. Subsequently the S&P/ASX 200 gave up much of the months gains but still managed to finish the month in the green.

In line with the global trend, Technology emerged as the best performing sector with a return of 5.2% in May. It was closely followed by the Utilities and Real Estate sectors, which also showed strong performance, yielding returns of 3.5% and 2%, respectively.

Domestic and International Fixed Income

Australian bonds settled 0.31% higher in May. Bonds rallied in the first half of the month following economic data suggesting that the recent RBA rate hikes may have been effective. This drove yields lower and bond prices higher. However, the market gave most of this back in the second half of the month with a higher-than-expected inflation reading ending the month, weighing on investor sentiment. The persistence of inflation in Australia has even led some leading economists to question whether the RBA may need to hike rates once again to regain control of inflation. Despite the volatility, domestic fixed income finished marginally positive for the month.

Globally, bond prices rose by 0.83% for the month of May. US data reports were the main driver of performance in international bond markets, in particular data suggesting that the US labour market is starting to soften whilst inflation continues its downward trajectory, this provided a tailwind for markets. As a result, US 10-Year Treasury yields fell from 4.64% to 4.56% over the month. Elsewhere, inflation in the UK fell to the lowest level since Jully 2021 and subsequently drove UK Gilts yields lower.

Australian Dollar

The Australian Dollar rose in May, gaining 2.47% relative to the US Dollar with 1 AUD growing from 0.649 USD to 0.665 USD. This was driven by a rally in commodities in the first half of the month, including copper and gold as well as higher than expected inflation readings in the later part of the month. This contrasted with a cooler US inflation reading which caused the US dollar to weaken against many of its counterparts, further boosting the Australian dollar performance.

Commodities – Gold and Oil

Oil fell in May by 5.08% off the back of higher-for-longer interest rates, bearish sentiment in broader financial markets and signs of slowing demand from China.

Gold prices on the other hand have reached new highs, breaking $2400 per ounce once more despite high bond yields and a persistently strong US dollar. Much of this outperformance can be attributed to rising geopolitical tensions over the month providing a tailwind to safe haven assets such as gold, resulting in a gain of 1.21% for the month.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.