Market Review – October 2023

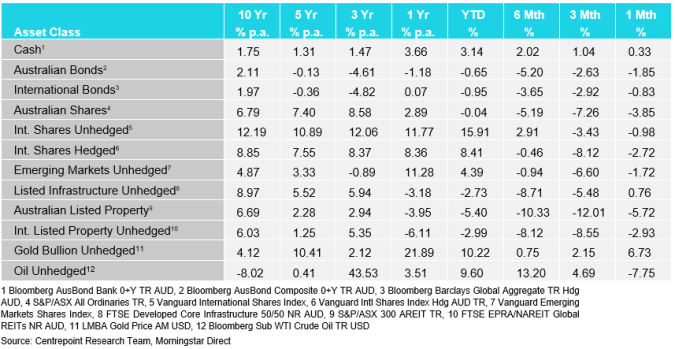

How the different asset classes have fared:

(As at 31 October 2023)

International Equities

International Equities fared better in October than September but still retreated as both unhedged and hedged shares fell by 0.98% and 2.72% respectively. Hedged falling further due to the continuing strength of the United States Dollar as the Fed retains high interest rates.

Most sectors saw an initial dip at the start of the month, remaining flat in the middle, and an eventual decline in the second half of the month. The only sector to have a positive return over the month was Utilities with a gain of just 0.54%, the next best was Technology with a loss of 0.87%. The biggest losers were Consumer Discretionary, Energy, and Industrial, with a loss of 4.79%, 4.42%, and 4.17% respectively.

The Energy sector in particular had a rollercoaster of a month, starting with steep decline before rising due to the escalation in the Israel-Palestine conflict, and eventually falling back down as it became clearer that the conflict would not spill into other countries in the region.

Australian Equities

Australian Equities performed worse in October than in September with a further decline of 3.85% with just one sector in the green. That one positive sector was Utilities with a gain of 1.6% with the next sector being Materials quite a bit behind at -1.2% and then Communications further still at -2.8%.

The three biggest detractors in the market were the Technology (-8%), Healthcare (-7.3%), and Industrials (-6.6%) sectors. Technology falling drastically as gains from earlier in the year were reversed by the effect of falling fervour surrounding Artificial Intelligence and high interest rates being maintained.

Part of the reason for the general retreat in equities was the continued elevation of interest rates and how this has pushed up long term bond yields, increasing their desirability as a risk-free investment.

Domestic and International Fixed Income

In October, Australian bond prices fell by 1.85%. This was once again due to the continued slow reduction in the rate of inflation leading the RBA to maintaining their current chosen cash rate. This further increasing the expected level of rates in the future, elevating bond yields and lowering prices.

International bond prices fell by 0.83% over the month as a very similar situation played out overseas. The most popular bonds, U.S. bonds, did not fall as far as Australian bonds. This was because their high yield levels made them extremely desirable among investors, who then shifted some of their funds from equities to bonds. This shift cushioned the price of U.S. bonds and prevented them from falling further.

Australian Dollar

The Australian Dollar (AUD) rose by 0.33% over the month, just 0.01% higher than last month’s increase. The AUD appreciated against the Euro, United States Dollar, Great British Pound, and the Japanese Yen. This could be due to either the high yields on Australian bonds or the fact that the AUD exchange rates have been at very low levels recently and investors see it as currently priced at a discount.

Commodities – Gold and Oil

Gold rose by 6.73% in October after declining the previous month. This rise could be from the high level of demand for gold from Central Banks globally. It could also be due to investors believing that we are very close to peak interest rates, at least in the U.S., convincing these investors to trickle back into gold.

Oil had a turbulent time in October but ended the month down 7.75%. The price of oil was declining at the start of the month before Hamas invaded Israel and Israel subsequently retaliated with force. This led to fears that the conflict would spread to include other countries in the region such as Iran and disrupt oil trade in the region, but as the conflict continued these fears dissipated and the price of oil continued to decline.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.