Market Review – September 2021

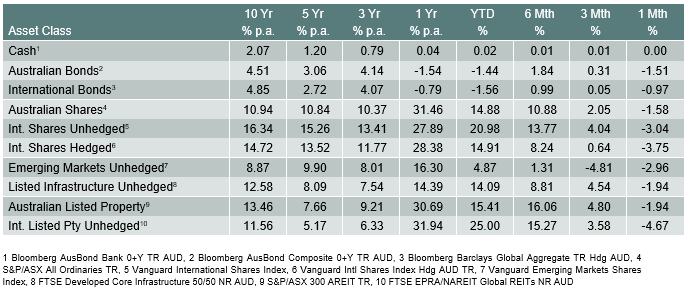

How the different asset classes have fared:

(As at 30 September 2021)

International Equities

International share markets (unhedged) fell by -3.04% in September. The performance of hedged and unhedged shares is now fairly similar over longer time periods. However, with a weaker A$, unhedged shares are now outperforming hedged over the past 6 and 12 months. Share markets fell because of concerns about higher inflation and interest rates. The sharp selloff in Chinese property developers weighed on emerging market shares.

The vaccine rollout continues to be a good news story and is progressing well in both the US and Europe, despite concerns about the spread of the “Delta” variant of Covid-19. Market valuation, particularly in the world’s largest share market, remain a key risk, with the US share market trading at valuation levels last seen just prior to the 2000 crash. In other countries valuations are at the upper end of the range, but are nowhere near as excessive as is the case in the US.

Australian Equities

The S&P/ASX All Ordinaries Index fell by -1.6% in September, largely following international markets. There are some risks that the prolonged lockdowns may impact the real economy and market sentiment negatively. However, the Australian vaccine rollout is finally starting to gain momentum, with credible forecasts of 90% vaccination rates likely to be achieved by late October in some states. A risk factor for Australian shares is the continued fall in iron ore prices. The falling value of the A$ will however partially offset these falls.

Domestic and International Fixed Income

Australian government bond yields rose in September, leading to capital losses in Australian and international fixed interest markets. The RBA has quite clearly indicated that Australian cash rates are likely to be held at current levels for at least the next few years. In the US the Federal Reserve is under greater pressure to raise rates.

Australian Dollar

The Australian dollar fell modestly against the US dollar in September. If commodity prices continue to fall as we expect then we would anticipate a lower A$ in the future. We continue to prefer currency unhedged to currency hedged investments.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.