Market Review – July 2021

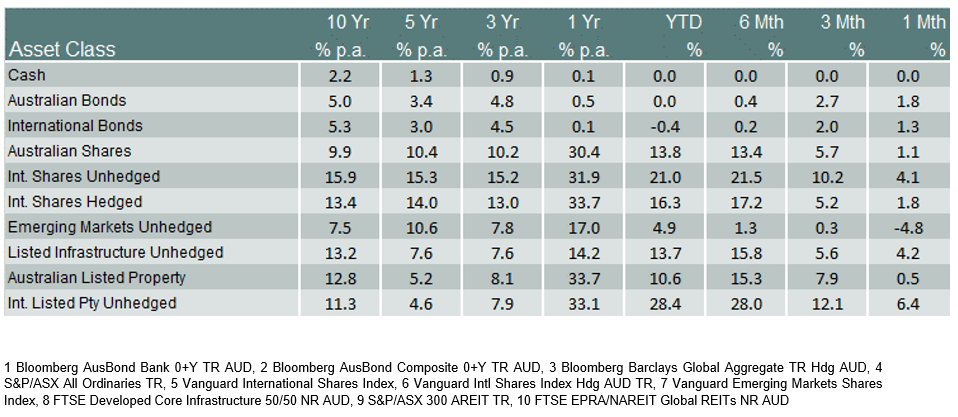

How the different asset classes have fared:

(As at 31 July 2021)

International Equities

International share markets (unhedged) rose by 4.1% in July. The weaker A$ helped with hedged international shares which did not benefit from the falling A$ only returning 1.8%. The US share market continues to edge higher. European shares also delivered positive returns. Chinese and Hong Kong share markets experienced a more difficult period; with concerns rising amongst property developers who are facing government restrictions on their capacity to borrow; and big Chinese technology companies who seem to have fallen out of favour with the Chinese authorities.

Overall, share markets continued to be underpinned by a strong recovery, due to the ongoing rollout of vaccines and lower long-term interest rates. However, there are some areas of concern. Market breadth which measures participation in the market is becoming narrower, with fewer and fewer large capitalization stocks responsible for driving the market higher.

Australian Equities

The S&P/ASX All Ordinaries Index rose by 1.1% in July, supported by continued strength in the domestic economy. Sentiment remains positive despite the widening round of Covid-19 related lockdowns in Sydney and other capitals. Unlike the first round of lockdowns there are not aggressive stimulus packages in place. A key issue for both the Australian share market and the Australian economy is just how quickly Australia can roll out its vaccination program. There are some grounds for optimism, with additional vaccine supplies becoming available.

Domestic and International Fixed Income

Australian government bond yields and US Treasury yields both moved lower in June, leading to capital gains in fixed interest markets. The RBA has quite clearly indicated that Australian cash rates are likely to be held at current levels for at least the next few years. The rise in capital values for bonds and most fixed interest funds is welcome. Investors depending on fixed interest investments to deliver income, will continue to experience low levels of interest rates over the coming periods.

Australian Dollar

The Australian dollar fell by around 2% against the US dollar in July and is now lower for the calendar year to date, amid broad US dollar strength. The US dollar rose against most currencies.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.